With business re-openings afoot, the focus shifts to recovery.

As the initial wave of lockdowns begins to ease in phases, the conversation surrounding the economy has shifted to recovery. Re-openings locally and nationally have spurred improved consumer confidence. Fueled by a federal stimulus package, strong rehiring led to 2.5 million workers added to company payrolls in May. However, in recent weeks, increases in new cases of COVID-19 have dampened some of that optimism.

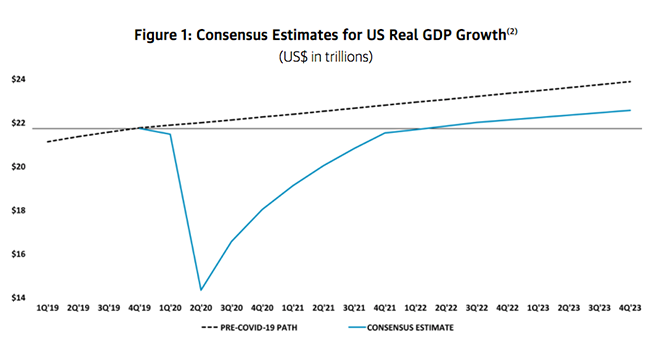

Economic Recovery Predictions

While predictions continue to vary widely, several notable economists and investment firms have recently weighed in on the future of the economy. We explore a few predictions here.

- The “V-Shaped Recovery”

Morgan Stanley doubled down this week on its prediction of a “sharp but short” recession ending by the second quarter of 2021, citing “recent upside surprises in growth data and policy action.” Of the handful or so of predictions circulating among economists, The Brookings Institution describes this prediction as the most optimistic: Here, “the economy permanently loses the production that would have occurred absent the pandemic, but very quickly returns to its pre-pandemic baseline once social distancing is lifted. Once life returns to normal, everything is just as it would have been before.”

- The “Square Root-Shaped Recovery”

A recently published thesis by Joe Zidle, Managing Director at Blackstone, took a more tempered view of economic recovery, suggesting a “square root recovery, characterized by 1) the initial sharp drop that we have already experienced; 2) a sharp, but smaller, bounce back to a lower level; and 3) a long, flat recovery.” - The “Nike Swoosh-Shaped Recovery”

Similar, more cautious predictions such as the “Nike Swoosh Shaped Recovery” forecast an economy that starts to bounce back sharply as restrictions are lifted and economic activity starts to increase, but consumers, businesses and state and local governments are still hesitant to spend. In this model, it takes a long while for the economy to get back to that pre-pandemic trajectory (per The Brookings Institution).

Recovery from the Real Estate Perspective

Turning to real estate, the coronavirus impact on commercial real estate remains significant. Meanwhile, the housing market continues to show strong fundamentals based on supply and demand, and affordability has improved largely in part due to home mortgage rates dipping to all-time lows.

Per Zidle, “confidence is key” where housing is concerned, and this market can’t truly take off until the pandemic is contained and consumers adjust to that phrase we keep hearing, the “new normal.” Albeit, things may be returning to normal sooner rather than later, as mortgage applications for purchases have rebounded to pre-pandemic levels (per Bloomberg).

Whether the recovery is shaped like a V, a square root symbol or a Nike Swoosh, we believe that with recovery comes opportunity. And when opportunity knocks, Juniper Capital will be here to help you finance your next real estate project. Juniper Capital provides private real estate financing, including hard money loans for commercial, construction, multi-family housing opportunities and more. If you would like more information on this topic, give us a call to talk to one of our experienced loan officers and start the conversation today.