One of the largest investments in the U.S. commits to revitalizing existing and building out new domestic infrastructures. As a result, investment opportunities abound for many real estate sectors.

Hundreds of billions of dollars will be invested in infrastructure, including transportation, a commitment to build cleaner electricity, and money to build and retrofit homes and commercial buildings, and much more, fueling optimism in the real estate industry. We see opportunities reaching different types of real estate investors: residential, commercial, and environmentally conscious.

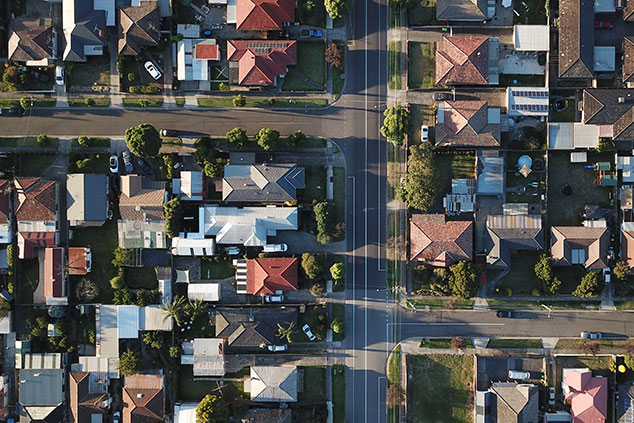

Residential Real Estate

Part of Biden’s Build Back Better Act (going before the Senate next, at the time of this writing) seeks to pass the Neighborhood Homes Investment Act (NHIA), which offers billions in tax credits to developers and investors over the next five years to build or rehabilitate roughly 500,000 owner-occupied homes. This initiative can lead to opportunities in affordable housing and other residential real estate investing opportunities.

The Act invests billions in creating new or upgraded homes for American homeowners and renters. For real estate investors, it might be worth following where the job creation starts revving up. That way, investors can enjoy the benefits of federal grants and tax incentives coming down the pipeline and go where overall investments are happening most heavily.

The Build Back Better framework expands rental assistance for Washington state renters, while also increasing the supply of high-quality housing through the construction and rehabilitation of over 1 million affordable housing units nationwide. It will address the capital needs of the entire public housing stock in America and it includes one of the largest investments in down payment assistance in history, enabling more first-generation homebuyers to purchase their first home.

Even home-building real estate or raw materials stocks that are part of housing projects, and relevant real estate investment trusts (REITs) are opportunities outside of direct land/real estate investments for the individual.

Commercial Real Estate

Construction in certain areas usually helps attract individual investors who want exposure to real estate because there’s going to be organic growth spillover.

Developers and investors will be watching where major projects will be taking place. These signal attractive communities to come live and work, resulting in more real estate investments. As areas become revitalized, by extension commercial and residential real estate values tend to grow.

This is a good time to mention that the Biden administration plans to treat taxes because investing in real estate comes with tax benefits, which may be implicated by Biden’s tax proposals.

We’ve discussed previously on our blog the potential elimination of the 1031 exchange rules and carried interest tax treatment, along with a potential increase in capital gains. The 1031 exchange allows real estate investors to postpone paying taxes on investment gains when selling an investment property if those proceeds are invested in a similar property. As the Build Back Better Act makes its way through the Senate, we’ll be watching what happens with these tax rules.

Environmentally Conscious Real Estate

The Biden administration intends to provide tax credits that will incentivize building a stable electronic transmission system and clean energy generation. This targets climate and clean energy investments aimed at making bridges, airports, and transit and delivering clean energy to power up buildings, communities, and businesses.

Realizing this means mobilizing companies that specialize in the construction of proposed green developments and clean energy experts. This creates the opportunity for real estate investors to get involved in energy-efficient investments and sustainability initiatives.

Imagine retrofitting upward of a million buildings with new efficient LED lighting, efficient electric appliances, and transitioning from fossil fuels to clean renewable electric energy. This transformative shift from fossil fuel-run commercial buildings to electric energy is massive. Upgrading existing commercial buildings with environmentally-friendly developments offers the real estate investor to get involved in these next-generation investments.

As we watch both the Bipartisan Infrastructure deal and the still-pending Build Back Better Act shift to implementation, Juniper Capital will be here to help you finance your next real estate project.

Juniper Capital provides private real estate financing, including hard money loans for commercial, construction, multi-family housing opportunities and more in the Pacific Northwest. If you would like more information on this topic, give us a call to talk to one of our experienced loan officers and start the conversation today.